Campaign 2020 launches into full gear: “I’m not sure how long America can kick the long-term care can down the road,” commented Jesse Slome, director of the American Association for Long-Term Care Insurance (AALTCI). Slome was speaking to leading insurance professionals.

“Covid 19 is the accelerant that has changed so many things; will it finally change how campaign 2020 ranks the importance of helping Americans deal with long-term care?” questioned Slome, who founded the long-term care insurance organization in 1998. “Covid 19 is uncovering the very reason this issue is of paramount importance to the nation’s future.”

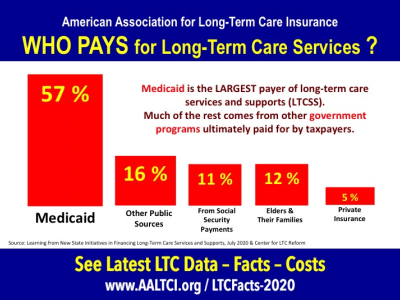

The future of Medicaid is going to be heavily dependent on how the federal government and states address long term care support services (LTCSS). According to AALTCI Medicaid pays more than half (57%) of LTCSS costs. When you include other public sources and payments taken from people’s Social Security benefits, it’s over 80 percent.

The future of Medicaid is going to be heavily dependent on how the federal government and states address long term care support services (LTCSS). According to AALTCI Medicaid pays more than half (57%) of LTCSS costs. When you include other public sources and payments taken from people’s Social Security benefits, it’s over 80 percent.

“Medicaid costs are shared between federal and states which basically means taxpayers will ultimately pick up the bill,” Slome explains. “And while the Federal government can print money, last I heard states don’t have that capacity so at some point we are going to reach a breaking point.”

Slome doesn’t view long-term care insurance as a universal solution for the problem. “Unfortunately, private solution is viable for those who can afford the premiums and meet the age and health qualifications,” he acknowledges. “But it should be part of the future equation in some form because every individual who takes responsibility for their own future is one less person who’ll turn to taxpayers for their needs.”

Campaign 2020 – Watch Nursing Homes Seeking More Federal Bailouts

“Watch for nursing homes to drive the need to address the whole long-term care financing topic,” Slome predicted for the group. “Even before Coronavirus they were facing issues and since then I’ve been reading about more companies who are on the verge of bankruptcy. Everyone will be yelling about their need for money and hopefully at some point smarter minds will start to look at viable longer term options and solutions.”

In the meantime, Slome suggested those insurance agents who market long-term care insurance communicate with their elected officials. “I’d clearly state an understanding of the immediate problems that need addressing,” he noted. ”But advocate that at some point a longer term outlook would benefit their constituents and the nation.”

To learn more about long-term care planning and to connect with local specialists visit the Association’s website at www.aaltci.org or call 818-597-3227.

LEARN MORE ABOUT LONG-TERM CARE INSURANCE PROTECTION. Get a free, no obligation quote for Long-Term Care Insurance from the American Association for Long-Term Care Insurance. Click here now!

INSURANCE AGENTS. SELL MORE LONG-TERM CARE INSURANCE PROTECTION. Visit the Association's Online LTC Learning, Marketing & Sales Center. Click here now!

HAVE YOU HEARD ABOUT CRITICAL ILLNESS INSURANCE? Learn more from the American Association for Critical Illness Insurance. Click here now!

MEDICARE SUPPLEMENT INSURANCE COSTS

Click here to learn more!