The vast majority, some 97 percent of individuals who are notified that the cost for their long-term care insurance policy will increase keep their coverage.

“One of the largest fallacies among consumers is that people drop their insurance protection when they face a rate increase, that’s simply not true,” explains Jesse Slome, director of the director of the American Association for Long-Term Care Insurance. “It’s really unfortunate that the real truth is rarely shared.”

Slome was sharing data from a just concluded report revealing what 172,000 participants in the Federal long-term care insurance program did when they faced an average 83 percent rate increase.

“Consumers read about rate increases and 80 percent certainly is a significant rate increase but they mistaken assume people drop their coverage,” Slome shared with an elite group of long-term care insurance professionals. “Thank goodness Congressional groups requested information when John Hancock announced rate increases on participants in the nation’s largest long-term care insurance program.”

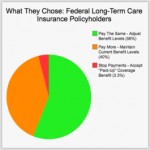

According to the report, some 172,000 individuals out of the 274,000 total plan enrollees face a rate increase. “About 96,000, or 56 percent, chose the option that maintained their current cost,” Slome explained. “It’s never a take-it-or-leave it choice. These individuals will continue to pay the same cost after re-evaluating their need and adjusting their future benefits.”

Some 40 percent of the affected policyholders agreed to pay the higher price. “We handle many calls from consumers who find that new coverage will cost significantly more than their current plan with the higher premium cost,” Slome acknowledged.

The national long-term care insurance expert noted that only 3.3 percent of the policyholders decided to stop paying premiums. “They did not lose their money paid,” Slome adds. “That’s a mistaken perception. They receive what’s called ‘paid-up nonforfeiture coverage’ which generally means they can get benefits equal to the total amount of premiums they paid.”

Slome also shared that the Federal plan reports paying $14 million in claims per-month for about 4,500 plan enrollees who are on claim. The average benefit paid per claimant to date equals about $64,000. “Some claims are small, and some are much larger which is why long-term care insurance protection is so important,” Slome told the group.

Established in 1998, the American Association for Long-Term Care Insurance creates heightened consumer awareness for the importance of long-term care planning and supports professionals who market the range of long-term care insurance solutions. For more information or to request long-term care insurance costs from experienced agents go to www.aaltci.org.

LEARN MORE ABOUT LONG-TERM CARE INSURANCE PROTECTION. Get a free, no obligation quote for Long-Term Care Insurance from the American Association for Long-Term Care Insurance. Click here now!

INSURANCE AGENTS. SELL MORE LONG-TERM CARE INSURANCE PROTECTION. Visit the Association's Online LTC Learning, Marketing & Sales Center. Click here now!

HAVE YOU HEARD ABOUT CRITICAL ILLNESS INSURANCE? Learn more from the American Association for Critical Illness Insurance. Click here now!

MEDICARE SUPPLEMENT INSURANCE COSTS

Click here to learn more!