Just released findings from researchers have yielded a tool that helps predict the life expectancy of patients with dementia according to the American Association for Long-Term Care Insurance.

Just released findings from researchers have yielded a tool that helps predict the life expectancy of patients with dementia according to the American Association for Long-Term Care Insurance.

“With good accuracy Swedish researchers studied over 50,076 patients,” shares Jesse Slome, director of the long-term care insurance organization. Patients with dementia were followed starting in 2007 for a maximum of 9.7 years.

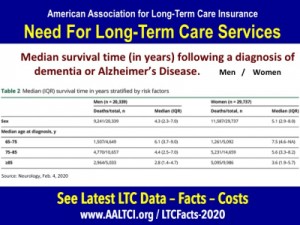

The researchers reported that the median survival time from dementia diagnosis was 5.1 years for women and 4.3 years for men,” Slome shared. Dementia and Alzheimer’s accounts for the most common reason individuals with long-term care insurance claim benefits. In some cases, they can amount to long-term care insurance claims that in total have exceeded hundreds of thousands of dollars.

Median survival time varied by the age at which the condition was discovered. For example, for men, the median survival time was 6.1 years for men diagnosed between ages 65 and 75, 4.4 years when diagnosed between ages 75 and 85 and 2.8 years when diagnosed after age 85. For women, the survival time was 7.5 years, 5.6 years and 3.6 years respectively.

“If you live a long life, the likelihood of dementia or Alzheimer’s increases exponentially and the importance of having some long-term care insurance in place is vital,” states Slome. “The new findings from these researchers can help insurance agents better educate consumers in terms of how much coverage they may need.” The researchers said the results are nearly identical to those of a similar study in the United Kingdom.

The Association director stressed that long-term care planning needs to begin well before there is the risk of needing care. “Far too many people call the Association once their parent has been diagnosed with some condition and their doctor suggests they look into insurance,” Slome admits. “Unfortunately even physicians don’t understand that long-term care insurance is only available to those who can still meet health qualifications and pass cognitive assessments.”

“If you are worried about what will happen should you ever get Alzheimer’s, the smart move is to talk to a long-term care insurance specialist to find out if you can currently qualify and how much insurance protection will cost,” Slome advises.

To learn more about long-term care planning visit the Association’s website or to connect with a specialist who can explain both traditional and hybrid products contact the Association via their website or call 818-597-3227.

LEARN MORE ABOUT LONG-TERM CARE INSURANCE PROTECTION. Get a free, no obligation quote for Long-Term Care Insurance from the American Association for Long-Term Care Insurance. Click here now!

INSURANCE AGENTS. SELL MORE LONG-TERM CARE INSURANCE PROTECTION. Visit the Association's Online LTC Learning, Marketing & Sales Center. Click here now!

HAVE YOU HEARD ABOUT CRITICAL ILLNESS INSURANCE? Learn more from the American Association for Critical Illness Insurance. Click here now!

MEDICARE SUPPLEMENT INSURANCE COSTS

Click here to learn more!