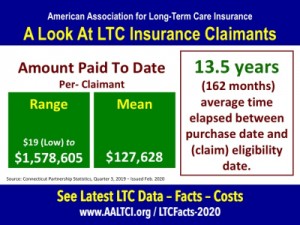

The average time between the purchase of long-term care insurance coverage and inception of a claim is 162 months according to the American Association for Long-Term Care Insurance.

The average time between the purchase of long-term care insurance coverage and inception of a claim is 162 months according to the American Association for Long-Term Care Insurance.

“Unlike other insurance where you might have a claim almost immediately, there needs to be a long period of time before a claim is expected to occur,” explains Jesse Slome, director of the American Association for Long-Term Care Insurance (AALTCI). “You may pay $2,000 a year with the anticipation of receiving $200,000 in ultimate benefits and that isn’t possible if people were all immediately claiming on their policies.”

Slome was sharing the most recent data shared by the Connecticut Partnership for Long-Term Care. Connecticut, one of four original Partnership states has been gathering and reporting data consistently since the mid 1990s.

“You typically buy a long-term care insurance policy between the ages of 55 and 65, which means you are most likely to need the benefits and receive car in your 80s,” Slome explains. “If you pay that $2,000 a year for 15 years, you have paid in $30,000. For those who have significant claims, it’s an incredible value. For those who never need long-term care, I don’t think they are disappointed that they avoided a lengthy stay in a nursing home or being dependent on having caregivers in their own home.”

The long-term care insurance expert was sharing data with insurance professionals who market various long-term care insurance policies. “According to the latest Connecticut the amount paid to claimants ranged from $19 to $1.5 million,” Slome acknowledged. The mean amount paid to claimants was $127,628.

Slome advised increased education among consumers making more people aware of how long-term care insurance works, when one needs to apply for coverage and how people benefit from the protection.

To obtain long term care insurance quotes from a professional with expertise specifically in long term care insurance products offered by multiple leading companies call the national organization at (818) 597-3227 or visit the Association’s website at www.aaltci.org.

LEARN MORE ABOUT LONG-TERM CARE INSURANCE PROTECTION. Get a free, no obligation quote for Long-Term Care Insurance from the American Association for Long-Term Care Insurance. Click here now!

INSURANCE AGENTS. SELL MORE LONG-TERM CARE INSURANCE PROTECTION. Visit the Association's Online LTC Learning, Marketing & Sales Center. Click here now!

HAVE YOU HEARD ABOUT CRITICAL ILLNESS INSURANCE? Learn more from the American Association for Critical Illness Insurance. Click here now!

MEDICARE SUPPLEMENT INSURANCE COSTS

Click here to learn more!