Insurance agents and financial advisors need to start considering the impact of future inflation on the benefits they offer advises the director of the American Association for Long-Term Care Insurance.

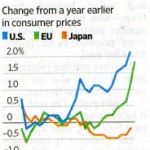

“The front page of today’s Wall Street Journal graphically tells the story of how prices are rising around the world and that can significantly impact long-term care planning,” declares Jesse Slome, director of the American Association for Long-Term Care Insurance. Slome issued an advisory to insurance and financial professionals to make sure they take the potential inflationary risk into account when working with clients and prospects.

“Based on our studies, the typical person purchasing long-term care insurance today is say age 60,” Slome notes. “But, they generally won’t access benefits from their traditional long-term care insurance policy until they are age 85 or considering advances in medicine and longevity, perhaps until they are in their 90s.”

The long-term care expert shared an example of the potential devastating impact of inflationary cost increases could pose on a potential consumer. “A modest two percent yearly increase in costs means today’s costs will be 61 percent higher in 25 years an 78 percent higher in 30 years,” Slome explains.

If costs rise just three percent annually, according to Slome, the future value of what many people purchased today may simply be far less of a benefit than they anticipated. “:If the insurance protection you buy today lacks a provision to increase, you’ll get some benefit and something is always better than nothing,” Slome adds.

“A three percent modest annual increase in costs means that someone age 60 will face costs that are 103 percent higher when they are 85,” Slome calculates. “Their policy will still be in force even if the insurance or financial advisor is no longer active.”

Slome serves as director of the American Association for Long-Term Care Insurance (AALTCI) that was founded in 1998 and is a national organization based in Los Angeles. To learn more about long-term care insurance costs and options visit the Association’s website or call 818-597-3227.

LEARN MORE ABOUT LONG-TERM CARE INSURANCE PROTECTION. Get a free, no obligation quote for Long-Term Care Insurance from the American Association for Long-Term Care Insurance. Click here now!

INSURANCE AGENTS. SELL MORE LONG-TERM CARE INSURANCE PROTECTION. Visit the Association's Online LTC Learning, Marketing & Sales Center. Click here now!

HAVE YOU HEARD ABOUT CRITICAL ILLNESS INSURANCE? Learn more from the American Association for Critical Illness Insurance. Click here now!

MEDICARE SUPPLEMENT INSURANCE COSTS

Click here to learn more!