A common question posed by consumers was answered today by the director of the American Association for Long-Term Care Insurance.

“We frequently get asked how long people can expect to pay for long-term care insurance before they’ll need or use the policy,” explains Jesse Slome, director of the American Association for Long-Term Care Insurance. “Unlike car accidents which we see so often, or health issues where we use health insurance, long-term care insurance is still a form of protection that few have experience with.”

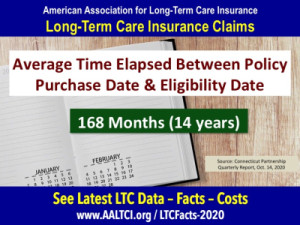

According to Slome the average elapsed time between the purchase of a long-term care insurance policy and the start of a claim is 168 months (14 years). “That’s the average so of course there are some that go on claim much sooner and some that start later,” Slome notes. “The typical purchaser is between ages 55 and 60, which means their claim generally starts after they reach age 80.”

The long-term care insurance expert has been exploring top questions posed by consumers calling the organization. Slome shared with insurance professionals the need to put the information about this data into context. “If an insurer anticipating having to pay claims almost immediately, the cost for a policy would be 10 to 20 times higher,” Slome anticipates. “Think of this like a retirement fund like your 401k that you start funding at age 35. You pay a small amount relatively each year so that you have a larger accumulation when you ultimately retire and stop working.”

When it comes to long-term care insurance claims, Slome shared data reported by the Connecticut Partnership For Long-Term Care. The special partnership between the State and insurers reported data based on some 4,800 policy claims.

2020 Claims Statistics: The Association director noted plans to continue to share relevant data throughout Long-Term Care Awareness Month (November). To access the latest long-term care insurance statistics go to https://www.aaltci.org/long-term-care-insurance/learning-center/ltcfacts-2020.php.

The American Association for Long-Term Care Insurance advocates for the importance of planning and supports insurance professionals who market long-term care insurance. To get information or request long-term care insurance quotes from a specialist in your area call the organization at 818-597-3227 or visit their website at www.aaltci.org.

LEARN MORE ABOUT LONG-TERM CARE INSURANCE PROTECTION. Get a free, no obligation quote for Long-Term Care Insurance from the American Association for Long-Term Care Insurance. Click here now!

INSURANCE AGENTS. SELL MORE LONG-TERM CARE INSURANCE PROTECTION. Visit the Association's Online LTC Learning, Marketing & Sales Center. Click here now!

HAVE YOU HEARD ABOUT CRITICAL ILLNESS INSURANCE? Learn more from the American Association for Critical Illness Insurance. Click here now!

MEDICARE SUPPLEMENT INSURANCE COSTS

Click here to learn more!