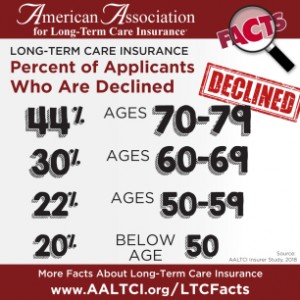

Roughly half of those who apply for long-term care insurance after age 70 are declined according to preliminary 2019 findings reported by the American Association for Long-Term Care Insurance (AALTCI).

“People mistaken believe that they can apply for long-term care insurance at any age and that’s clearly never been true,” according to Jesse Slome, AALTCI’s director. “In fact, our preliminary findings reveal that insurers have learned quite a bit about who is at risk and how much long-term care claims can potentially cost, which means they scrutinize every applicant’s health more than ever before.”

The Association is collecting data regarding applicants for long-term care insurance policies. “The last time we looked at industry decline rates was 2014 and we know things have changed in the ensuing five years,” Slome explained. “It is important information necessary to both educate insurance professionals as well as consumers who might want to investigate long-term care insurance as an option to cover potential risk of needing care at home or in a skilled nursing facility.”

The Association is collecting data regarding applicants for long-term care insurance policies. “The last time we looked at industry decline rates was 2014 and we know things have changed in the ensuing five years,” Slome explained. “It is important information necessary to both educate insurance professionals as well as consumers who might want to investigate long-term care insurance as an option to cover potential risk of needing care at home or in a skilled nursing facility.”

“Some 44 percent of individuals who applied for coverage and were between the ages of 70 and 79 when they applied were declined back in 2014,” shares Slome. The Association gathered data from leading long-term care insurers based on age bands. “The decline rate was 30 percent for individuals between the ages of 60 and 69.”

“Preliminary data for 2019 shows a slight increase in the decline rate,” Slome noted. “If you ant to consider long-term care insurance as an option it is vitally important to begin the investigation process early, generally between 50 and 65 when you are still more likely to be able to health qualify for this coverage,” Slome advised. “The good news is that once the insurance company accepts you for coverage, you can not be cancelled even if and when your health changes.”

The Association plans to release finalized numbers shortly. In the meantime, those seeking data on long-term care insurance can visit the Association’s website where the latest studies and findings can be accessed at https://www.aaltci.org/long-term-care-insurance/learning-center/ltcfacts-2019.php

The American Association for Long-Term Care Insurance advocates for the importance of long-term care planning. Established in 1998, the organization connects consumers with knowledgeable professionals who are independent advisors for no-cost, no-obligation long-term care insurance costs quotes and policy comparisons.

LEARN MORE ABOUT LONG-TERM CARE INSURANCE PROTECTION. Get a free, no obligation quote for Long-Term Care Insurance from the American Association for Long-Term Care Insurance. Click here now!

INSURANCE AGENTS. SELL MORE LONG-TERM CARE INSURANCE PROTECTION. Visit the Association's Online LTC Learning, Marketing & Sales Center. Click here now!

HAVE YOU HEARD ABOUT CRITICAL ILLNESS INSURANCE? Learn more from the American Association for Critical Illness Insurance. Click here now!

MEDICARE SUPPLEMENT INSURANCE COSTS

Click here to learn more!