Prostate cancer will rank atop for the nearly 900,000 men in the United States will be diagnosed with cancer this year according to a teleconference call conducted this morning by the American Association for Critical Illness Insurance.

Prostate cancer will rank atop for the nearly 900,000 men in the United States will be diagnosed with cancer this year according to a teleconference call conducted this morning by the American Association for Critical Illness Insurance.

“Before this year ends, almost one million men will hear the dreaded words, you have cancer,” shares Jesse Slome, director of the organization. “Cancer is no longer a death sentence for most men but it will likely wreak havoc on their short-term and long-term finances. Few understand that’s the real risk they face.”

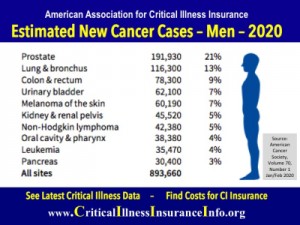

Prostate cancer will be the most common new cancer diagnosis impacting an estimated 191,000 men according to the American Cancer Society’s 2020 forecast. “The top five cancers that will be diagnosed in men this year include prostate cancer, lung cancer, colon and rectum cancer, urinary bladder cancer and melanoma of the skin,” Slome shared with a group of insurance marketing professionals.

Cancer will be the critical illness most likely to impact younger men, those between the ages of 40 and 70, Slome shared. “That’s why we advocate creating awareness for insurance solutions that offer both cancer insurance as well as more comprehensive critical illness insurance policies,” Slome added. “The comprehensive ci insurance policies generally cover between 12 and 16 common things like heart attack, stroke, coma, blindness and even deafness.”

Slome shared that the Association has just re-launched the organization’s website and an intensive awareness campaign. “There are millions of Americans between the ages of 35 and 55 who need to at least understand they have a risk, the consequences of that risk and that there are affordable options available that can be enormously valuable,” Slome says.

“About two thirds of men diagnosed with cancer in 2020 will still be alive five years from now,” Slome shared based on the organization’s 2020 cancer survival rate report. “The real toll is their finances because even with the best health care insurance, there are costs not covered and equally important the loss of income while undergoing treatment or recovery.”

“The gig economy is a reality for millions of men who are one diagnosis away from losing their income,” Slome notes. “If you need three months for treatments and time to heal, how will you pay your rent, your mortgage, your phone bill,” he questioned the group. “That is why I so strongly believe a cancer insurance policy or a critical illness insurance policy that equals one or two years of rent or mortgage payments is both affordable and so valuable.”

According to the critical illness insurance cost calculator on the Association’s website, a 45-year old male non-smoker can expect to pay $48 a year for $10,000 of cancer insurance. “If your mortgage is $2,000 monthly, for about $100 a year, you’d have the peace of mind that knowing you’d have the cash to cover payments while you get better and back to work,” Slome shared.

The American Association for Critical Illness Insurance is an advocacy and informational organization that strives to create heightened awareness for the planning options and supports insurance professionals who market insurance solutions. To learn more visit the organization’s website at www.criticalillnessinsuranceinfo.org.

LEARN MORE ABOUT LONG-TERM CARE INSURANCE PROTECTION. Get a free, no obligation quote for Long-Term Care Insurance from the American Association for Long-Term Care Insurance. Click here now!

INSURANCE AGENTS. SELL MORE LONG-TERM CARE INSURANCE PROTECTION. Visit the Association's Online LTC Learning, Marketing & Sales Center. Click here now!

HAVE YOU HEARD ABOUT CRITICAL ILLNESS INSURANCE? Learn more from the American Association for Critical Illness Insurance. Click here now!

MEDICARE SUPPLEMENT INSURANCE COSTS

Click here to learn more!