The findings of a new study of long-term care insurance policy claims should be shared with married couples urges the American Association for Long-Term Care Insurance (AALTCI).

The findings of a new study of long-term care insurance policy claims should be shared with married couples urges the American Association for Long-Term Care Insurance (AALTCI).

“With so many couples, there’s often one spouse who is resistant, usually the husband,” explains Jesse Slome, director of the long-term care insurance organization. “This new information will help those who have doubts understand the significant consequences and the benefits of this important protection.”

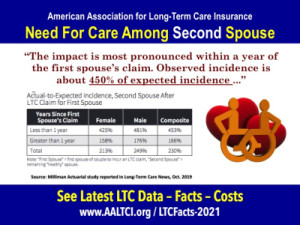

Slome was sharing data from a recently released study by Milliman Actuarial. “When one spouse has a long-term care claim, the odds of a claim by the second spouse is four times higher than would normally be expected,” Slome shared with a group of long-term care insurance sales professionals. Data comes from Milliman’s “Is Your Spouse Contagious” study.

Access the Milliman Couple Claims Report

Click here for the couple claims information.

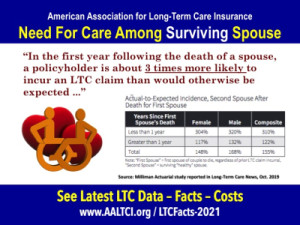

“ Following the death of a spouse who has been on a long-term care insurance claim, the odds of the second spouse needing long-term care within a year triples,” Slome adds. “You tell that to all the recalcitrant husbands who tell their wives, don’t worry honey, I’ll never need care but you get some if you like.”

Following the death of a spouse who has been on a long-term care insurance claim, the odds of the second spouse needing long-term care within a year triples,” Slome adds. “You tell that to all the recalcitrant husbands who tell their wives, don’t worry honey, I’ll never need care but you get some if you like.”

The Association director speaking to the group of long-term care insurance professionals noted that the Milliman analysis examined a pool of 50,000 long-term care insurance claims before the Covid-19 pandemic.

2021 Long-Term Care Insurance Statistics

See the latest long-term care insurance statistics and data posted by the Association.

“The need by the second or the surviving spouse was for both home care as well as facility care,” Slome pointed out. “Consumers need to understand that long-term care insurance provides benefits. And, that when insurers lower spousal discounts, as many are, there is a reason.” The Association recently reported that insurers were reducing available spousal discounts when both partners obtain coverage from 30 percent to 15 percent.

The American Association for Long-Term Care Insurance (AALTCI) advocates for the importance of planning and supports insurance professionals who market both traditional and hybrid LTC solutions. To obtain long-term care insurance costs call the organization at 818-597-3227 or visit their website at www.aaltci.org.

LEARN MORE ABOUT LONG-TERM CARE INSURANCE PROTECTION. Get a free, no obligation quote for Long-Term Care Insurance from the American Association for Long-Term Care Insurance. Click here now!

INSURANCE AGENTS. SELL MORE LONG-TERM CARE INSURANCE PROTECTION. Visit the Association's Online LTC Learning, Marketing & Sales Center. Click here now!

HAVE YOU HEARD ABOUT CRITICAL ILLNESS INSURANCE? Learn more from the American Association for Critical Illness Insurance. Click here now!

MEDICARE SUPPLEMENT INSURANCE COSTS

Click here to learn more!