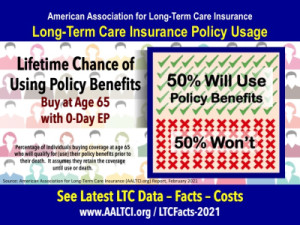

One out of two individuals who purchase long-term care insurance at age 65 will actually utilize their coverage according to data released by the American Association for Long-Term Care Insurance (AALTCI).

One out of two individuals who purchase long-term care insurance at age 65 will actually utilize their coverage according to data released by the American Association for Long-Term Care Insurance (AALTCI).

“It’s a 50-50 probability that someone getting long-term care insurance at age 65 will use their coverage and that’s a significant piece of information few consumers understand,” explains Jesse Slome, director of the long-term care insurance organization.

The organization worked with leading industry actuaries to review policy usage data. “We specifically looked at risks based on coverage that had a zero-day elimination period,” Slome adds. “Today, many policies have provisions or options that include access to immediate benefits for home care needs. And, since the vast majority of long-term care insurance benefits today pay for care at home, this made the most sense.”

The Association director acknowledged the likelihood of usage was less when a 90-day Elimination Period (EP) was used to factor risk. “Many people choose a 90-day EP specific to when benefits for skilled nursing home care would apply and that makes sense because Medicare covers some of that risk,” Slome notes.

Policy Usage for Long-Term Care Insurance (can be 50-50)

“Does having some long-term care insurance make financial sense?” Slome queries. “We insure our homes even though we know the risk of a house fire is far less than 50-50. The risk of needing care as we age is significantly high, and thus the answer is yes, having some protection in place makes prudent financial sense.”

The 50-50 usage projection assumes the individual purchases long-term care insurance at age 65 and maintains the policy until either they need benefits or die. The Association recently posted their 2021 long-term care insurance price index and other statistics and data on it’s website.

Headquartered in Los Angeles, the American Association for Long-Term Care Insurance (AALTCI) advocates for the importance of planning and supports insurance professionals who market both traditional and hybrid LTC solutions. Request long-term care insurance costs by calling the organization at 818-597-3227 or visit their website at www.aaltci.org.

LEARN MORE ABOUT LONG-TERM CARE INSURANCE PROTECTION. Get a free, no obligation quote for Long-Term Care Insurance from the American Association for Long-Term Care Insurance. Click here now!

INSURANCE AGENTS. SELL MORE LONG-TERM CARE INSURANCE PROTECTION. Visit the Association's Online LTC Learning, Marketing & Sales Center. Click here now!

HAVE YOU HEARD ABOUT CRITICAL ILLNESS INSURANCE? Learn more from the American Association for Critical Illness Insurance. Click here now!

MEDICARE SUPPLEMENT INSURANCE COSTS

Click here to learn more!