A significant percentage of older individuals who applied for long-term care insurance were declined coverage by the insurance company according to the latest data.

A significant percentage of older individuals who applied for long-term care insurance were declined coverage by the insurance company according to the latest data.

“Individuals mistakenly believe they can purchase long-term care insurance at any age and without regard to existing health issues,” explains Jesse Slome, director of the American Association for Long-Term Care Insurance. “That is simply not the case. Your health, your height and weight and medications prescribed all are taken into account by the insurance company.”

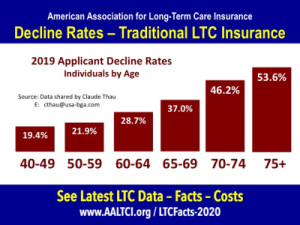

According to an analysis of applicants for traditional long-term care insurance in 2019, decline rates ranged from 19.4 percent for individuals applying between ages 40 to 49 to 53.6 percent after age 75.

“Couples comprise the majority of traditional long-term care insurance applicants,” explains Claude Thau, National Brokerage Director at USA-BGA, a national distributor or LTC protection. Thau helped compile the data as part of the 2020 Milliman Long-Term Care Insurance Survey. “The likelihood that at least one spouse will be declined ranges from 35.0 percent for spouses between ages 40 and 49 to 78.5 percent for couples age 75 or older.”

Long-Term Care Insurance Data

See 2020 long-term care insurance statistics and data. Click the highlighted link.

The information points out the importance of starting the research and application process early, Slome advises. “We generally recommend people begin investigating long-term care insurance in their early to mid-50s and ideally before they quality for Medicare,” he adds. “Particularly if you have some existing health conditions or take prescription medications for conditions other than common ones like high blood pressure and cholesterol it pays to talk to a knowledgeable long-term care insurance professional.”

The American Association for Long-Term Care Insurance (AALTCI) advocates for the importance of planning and supports insurance professionals who market both traditional and hybrid LTC solutions.

To see decline rate data by ages and other long-term care insurance statistics visit the organization’s website at www.aaltci.org/LTCFacts-2020.

LEARN MORE ABOUT LONG-TERM CARE INSURANCE PROTECTION. Get a free, no obligation quote for Long-Term Care Insurance from the American Association for Long-Term Care Insurance. Click here now!

INSURANCE AGENTS. SELL MORE LONG-TERM CARE INSURANCE PROTECTION. Visit the Association's Online LTC Learning, Marketing & Sales Center. Click here now!

HAVE YOU HEARD ABOUT CRITICAL ILLNESS INSURANCE? Learn more from the American Association for Critical Illness Insurance. Click here now!

MEDICARE SUPPLEMENT INSURANCE COSTS

Click here to learn more!