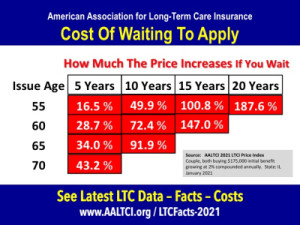

The cost of delaying when you purchase long-term care insurance can be as much as 147 percent according to new data released by the American Association for Long-Term Care Insurance (AALTCI).

The cost of delaying when you purchase long-term care insurance can be as much as 147 percent according to new data released by the American Association for Long-Term Care Insurance (AALTCI).

“The cost for long-term care insurance is based on your age when you apply among other factors,” explains Jesse Slome, director of the long-term care insurance organization. “Each year you wait is going to cost you more.”

According to an analysis conducted by the Association, a 55-year-old couple who both are applying, would face a 49.9 percent increase in costs if they delayed for 10 years. The cost difference would be 100.8 percent if they waited 15 years.

“But, this assumes insurance companies maintain the current rate levels in the future,” Slome notes. “That hasn’t happened and so these numbers are likely the minimum increase outr hypothetical couple would face.”

Slome points out other risks that waiting can result in. “Your health is a most important factor and it’s likely not going to get better as you enter your 60s and 70s,” Slome adds. “You risk being declined completely or having to pay a higher premium because you are classified as more of a health risk. Finally, there’s the risk of losing the couple’s discount due to the death of one spouse, divorce or a denial of coverage for one of the spouses.”

The organization’s study looked at data for issue ages 55, 60, 65 and 70. A chart shows the price increase effect of waiting 5 years, 10 years, 15 and 20 years. To see the cost of waiting data from the Association’s 2021 analysis go to https://www.aaltci.org/ltcfacts-2021.

The American Association for Long-Term Care Insurance (AALTCI) advocates for the importance of planning and supports insurance professionals who market both traditional and hybrid LTC solutions. Request long-term care insurance costs by calling the organization at 818-597-3227 or visit their website at www.aaltci.org.

LEARN MORE ABOUT LONG-TERM CARE INSURANCE PROTECTION. Get a free, no obligation quote for Long-Term Care Insurance from the American Association for Long-Term Care Insurance. Click here now!

INSURANCE AGENTS. SELL MORE LONG-TERM CARE INSURANCE PROTECTION. Visit the Association's Online LTC Learning, Marketing & Sales Center. Click here now!

HAVE YOU HEARD ABOUT CRITICAL ILLNESS INSURANCE? Learn more from the American Association for Critical Illness Insurance. Click here now!

MEDICARE SUPPLEMENT INSURANCE COSTS

Click here to learn more!