We understand how upset people get when they receive a rate increase notification. The American Association for Long-Term Care Insurance has posted this page to help consumers better understand why insurers raise rates. And, what others do when they get a rate increase.

We cannot give anyone specific recommendations. But, we hope this information helps you better understand the reasons and the options. Thank you for taking the time to read.

Why Do Long-Term Care Insurance Raise Rates?

First, it is important to understand that insurers CAN NOT single out specific policyholders. They must file rate increases for a 'Class' of policyholders. That could be everyone who bought a particular policy in specific state(s) with specific policy features.

Second, insurers must demonstrate specific reasons that a rate increase is requested. Lack of profitability is NOT A VALID REASON to request a rate increrase.

Here are some main reasons insurers have requested rate increases:

What does this really mean? When insurers calculate pricing for long-term care insurance, they factor in a "lapse" rate. Simply said, they know that over time people will decide they no longer want to pay for this coverage.

Boy were they wrong! Insurers in the 1990s and early 2000s were conservative. But they still projected that (say) 4% would lapse their policy each year. Over say 20 years, 80% of policyholders would thus lapse their coverage.

What really happened? People DID NOT LAPSE THEIR COVERAGE. Only 1% did (or less). So a company that sold 100,000 policies and expected 20,000 after 20 years (20 x 4% = 80% dropped policies) ACTUALLY HAD 80,000 policies still in-force (20 x 1% = 20,000 lapsed policies). More policies meant more claimants.

To be preparded to pay future claims, insurers needed to raise rates.

States approve the increases to raise certainty that insurers are funded adequately to meet their responsibility to pay future LTC claims.

TODAY NEW POLICIES BEING SOLD generally use lapse rates of 1% (or maybe less). As a result, policies holders face little (if any) risk of a future rate increase. That's the good news. But newer policies COST A LOT MORE.

Click the link if you are interested in seeing Long-Term Care Insurance Costs For 65 Year Olds.

Data comes from a Milliman Actuarial study reported in 2022.

What Is The Typical Long-Term Care Insurance Policy Rate Increase?

Many rate incraeses are relatively small but some are large. Here's a look at averages:

Again, these are generalities for 2016 analysis and will vary by state. That's because some states limit rate increases. But the Milliman data gives a general sense.

Insurers Offer Options To Avoid The Rate Increase

Insurers offer policyholders options to avoid paying a rate increase (keep paying the same or about the same premium).

These will be explained to you in writing. You should read the information carefully.

Here's a look at some of the most common options offered to help policyholders offset a rate increase:

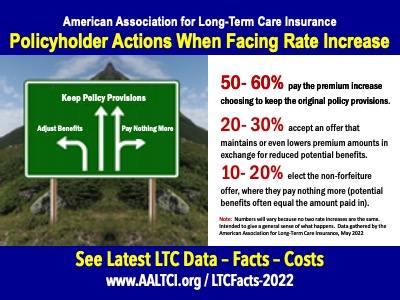

What Do Most Consumers Do When Facing A Rate Increase?

What do most people do? Here's our latest data. Read more statistics about buyers and claimants.

Long-term care insurance statistics

What Can YOU Do When Facing A Rate Increase?

Long-term care policy features and benefits can vary by state and by insurer.

But the following are the typical options you'll have. These will all be specifically outlined in written communications sent to you from the insurer.

Option 1. Keep Your Current Coverage

If you are able to pay the increased premium, you will keep your current level of coverage.

Option 2. Adjust Your Coverage

If you are comfortable having less coverage the insurer will typically offrer ways to reduce your benefits and premium. Below we outline some reasons to consider this.

Option 3. Pay Nothing More

If you'd like to stop paying premiums altogether, in most situations you'll receive a paid-up policy with benefits approximately equal to the total of premium paid. In other words, if you've paid $20,000 in total premiums over the years, the insurer will offer you $20,000 of benefits (you'll still need to meet policy claim qualifications).

WHY ADJUST COVERAGE?

Many people facing rate increases find that their policy has grown enormously in value. That initial Daily Benefit of $200-per-day is now $400 (or $12,000-per month). It's more than they think they might need. They often consider lowering or dropping the INFLATION GROWTH OPTION. Or they will reduce the Daily Benefit amount. It makes smart financial sense.

Many people find that their savings and assets are worth far more than when they bought the policy. You might realize that you can cover some of the risk yourself. So, if you worry about a $10,000 home care cost and adjusting your policy means it will provide $6,000, then you agree to cover the potential $4,000.

Common Ways To Adjust Your Long-Term Care Coverage

Lower Your Benefit Amount

Referred to as Daily or Monthly Maximums on your policy schedule page, this is the maximum amount that can be reimbursed for long term care expenses on a daily or monthly basis. It is also used to determine the maximum lifetime benefit amount on your policy. Lowering your benefit amount will reduce your premium. (Example: $350 per day daily benefit can be reduced to $250 per day).

Shorten Your Benefit Coverage Period

The benefit coverage period is the period of time used in calculating the policy payment maximum. Shortening your benefit coverage period will reduce your premium. (Example: Shortening a lifetime benefit period to a 3 or 4 year benefit period).

Lengthen Your Elimination Period

The Elimination Period is similar to a deductible. It is the number of days of covered care that you must pay for before your coverage begins to pay benefits. Lengthening your elimination period will reduce your premium. (Example: Changing the elimination period from 30 days to 100 days).

Decrease Your Inflation Protection

This option helps your coverage keep up with the rising cost of care by growing your Daily or Monthly Maximum and Coverage Maximum over time. Compound and simple increases are applied to your Daily or Monthly Maximum and remaining Coverage Maximum on each anniversary of your coverage effective date until you make a claim. Decreasing your inflation protection percentage will reduce your premium. (Example: Reducing your inflation protection from 5% to 3% or from compound increases to simple increases).

Cancel Riders

Some policies offer optional benefits that you may have purchased. Examples include First Day Home Care, Restoration of Benefits, and Survivorship. Cancel these to reduce your premium costs.

Are All Rate Increases Approved?

NO they are not. Insurers must demonstrate to the various State Department of Insurance that there is a real need.

And then it can take months to get a rate increase approved.

Valuable Resources for Consumers

2022 Long-Term Care Insurance statistics

WHAT SHOULD YOU DO

WHEN FACING A RATE INCREASE?

Read Everything Mailed To You,

Speak To The Insurer,

Re-Evaluate Your Current

Financial Status vs. Needs,

Be Sure NOT To Miss Deadlines,

Get All Details in Writing.

Unfortunately the Association is not able to give advice. Read the information on this page as it can be helpful.

CAN I FIND CHEAPER

NEW LTC INSURANCE?

If you've had a policy for 3+ years

YOU WILL NOT FIND A LESS EXPENSIVE NEW (EQUAL) OPTION.

New policies will cost more AND you'll have to meet new health qualifications. We suggest reading the options being offered and find the best one for you.

DO YOU HAVE MEDICARE INSURANCE?

Our sister organization, the American Association for Medicare Supplement Insurance, makes abailable the only online directory where you can find local Medicare insurance brokers. It's 100% free and 100% private to use.

Click the link.

Find Independent Medicare brokers

SAVE ON MEDICARE DRUG PLAN COVERAGE?

The typical senior who switches Medicare drug plans saves between $500 and $700 a year. Learn more. Click the link.

Find Best Medicare Drug Plan Costs

IMPORTANT DISCLAIMER

A message from Jesse Slome, director of the American Association for Long-Term Care Insurance (AALTCI).

The information on this webpage is as accurate and current as possible. Neither AALTCI nor Jesse Slome provide financial or legal advice. Speak to your insurance agent, financial advisor or accountant before making any decisions. Read everything carefully. Verbal representations are meaningless when it comes to insurance. Everything must be in writing and it's best to get this directly from the insurance company or the company they have designated to work withg policyholders.